Why You Should Talk to Your Parents About Estate Planning

Estate planning is something many families are inclined to put off however careful planning for the future can protect property and assets, as well as loved ones. An estate plan is not simply a matter of drafting a will; it is also a kindness to the surviving family members because it can relieve stress, help […]

Posted by reichertlegal

Posted by reichertlegal- Posted in Durable Power of Attorney Baltimore, Durable Power of Attorney Maryland, Estate Planning Annapolis Maryland, Estate Planning Anne Arundel County Maryland, Estate Planning Baltimore County, Estate Planning Baltimore Maryland, Estate Planning Columbia Maryland, Estate Planning Dundalk Maryland, Estate Planning Glen Burnie Maryland, Family Lawyer Baltimore Maryland, Uncategorized

Oct, 14, 2022

Oct, 14, 2022 No Comments.

No Comments.

How Do I Sell My House with a Reverse Mortgage in Maryland?

Simply put, a reverse mortgage is a loan that can be repaid at any time without penalty. Selling a home with a reverse mortgage is not unlike selling a home with a standard mortgage, but there are some key differences to keep in mind. If you are selling your home with a reverse mortgage, here […]

Posted by reichertlegal

Posted by reichertlegal- Posted in Anne Arundel Maryland House Title Deed Recording, Deed Filing Maryland, Property Title Company Anne Arundel Maryland, Property Title Service Company Baltimore Maryland, Property Title Service Company Frederick County Maryland, Uncategorized

Oct, 07, 2022

Oct, 07, 2022 No Comments.

No Comments.

Should I Transfer My Rental Investment Into an LLC?

If you are a property investor or thinking of becoming one, you may or may not be familiar with the benefits of forming an LLC. Purchasing property under your own name can expose you personally if the property is ever subject to liens, judgements, or lawsuits. Forming an LLC is a wise way to protect […]

Read More Posted by reichertlegal

Posted by reichertlegal- Posted in Attorney Baltimore Maryland, Business Formation Attorney Columbia Maryland, Business Formation Attorney Frederick Maryland, Business Formation Attorney Maryland, Business Law Baltimore, Business Law Maryland Business Formation, Uncategorized

Sep, 28, 2022

Sep, 28, 2022 No Comments.

No Comments.

What is a Tangled Title and What Can I Do About It?

A tangled title is a term used when you have inherited a home but the deed has not been legally transferred into your name. This may cause several difficulties, both practically and financially. For example, you may run into problems setting up utilities, obtaining a homeowner’s insurance policy, or taking out a home equity line […]

Posted by reichertlegal

Posted by reichertlegal- Posted in Estate Administration Clinton Maryland, Estate Administration Frederick Maryland, Estate Administration Montgomery County Maryland, Uncategorized

Sep, 21, 2022

Sep, 21, 2022 No Comments.

No Comments.

What Is a Surviving Spouse Entitled to Receive Under Maryland’s Elective Share Statute?

Maryland’s Elective Share Statute was designed to prevent a surviving spouse from being disinherited. House Bill 99, signed by Governor Hogan in 2019, expanded the assets included in calculating what a surviving spouse could inherit. Under the previous bill, only probate assets were subject to the elective share statute. Under the augmented statute, non-probate […]

Posted by reichertlegal

Posted by reichertlegal- Posted in Durable Power of Attorney Maryland, Estate Administration Attorney Maryland, Estate Administration Baltimore County Maryland, Estate Administration Carroll County Maryland, Estate Administration Frederick Maryland, Estate Administration Montgomery County Maryland, Estate Planning Anne Arundel County Maryland, Estate Planning Baltimore Maryland, Estate Planning Glen Burnie Maryland, Uncategorized

Sep, 14, 2022

Sep, 14, 2022 No Comments.

No Comments.

What New Parents Need to Know About Estate Planning?

While assembling a new crib or changing diapers, estate planning is probably the farthest thing from your mind. However, life’s busyness does not diminish the importance of making sure your family has everything they need in case something unfortunate were to happen to you. Where should you start? Begin with your living documents. […]

Posted by reichertlegal

Posted by reichertlegal- Posted in Estate Administration Attorney Maryland, Estate Planning Annapolis Maryland, Estate Planning Baltimore County, Estate Planning Baltimore Maryland, Estate Planning Carroll County, Estate Planning Glenmont Maryland, Estate Planning Severna Park, Uncategorized

Aug, 12, 2022

Aug, 12, 2022 No Comments.

No Comments.

Disabled Veterans and Surviving Spouses are Eligible for a Property Tax Exemption in Maryland

As you know, the state of Maryland provides many benefits to veterans of the Armed Services. If you are a disabled veteran, you may be eligible for a complete tax exemption on your property. There are no filing deadlines, so you are free to apply at any time. If you are the surviving spouse of […]

Posted by reichertlegal

Posted by reichertlegal- Posted in Uncategorized

Jul, 29, 2022

Jul, 29, 2022 No Comments.

No Comments.

SDAT Increases Business Personal Property Exemption

The Maryland State Department of Assessments and Taxation (SDAT) recently raised the exemption for all Maryland businesses on personal property assessment from $2,500 to $20,000. HB268 took effect on June 1, 2022 and will save Maryland businesses from paying over forty million dollars in assessments. This legislation also prevents the SDAT from the collection […]

Read More Posted by reichertlegal

Posted by reichertlegal- Posted in Business Formation Attorney Baltimore Maryland, Business Formation Attorney Columbia Maryland, Business Formation Attorney Ellicott City, Business Law Attorney Maryland, Business Law Baltimore, Business Law Maryland, Business Law Maryland C Corp, Business Law Maryland LLC, Uncategorized

Jul, 12, 2022

Jul, 12, 2022 No Comments.

No Comments.

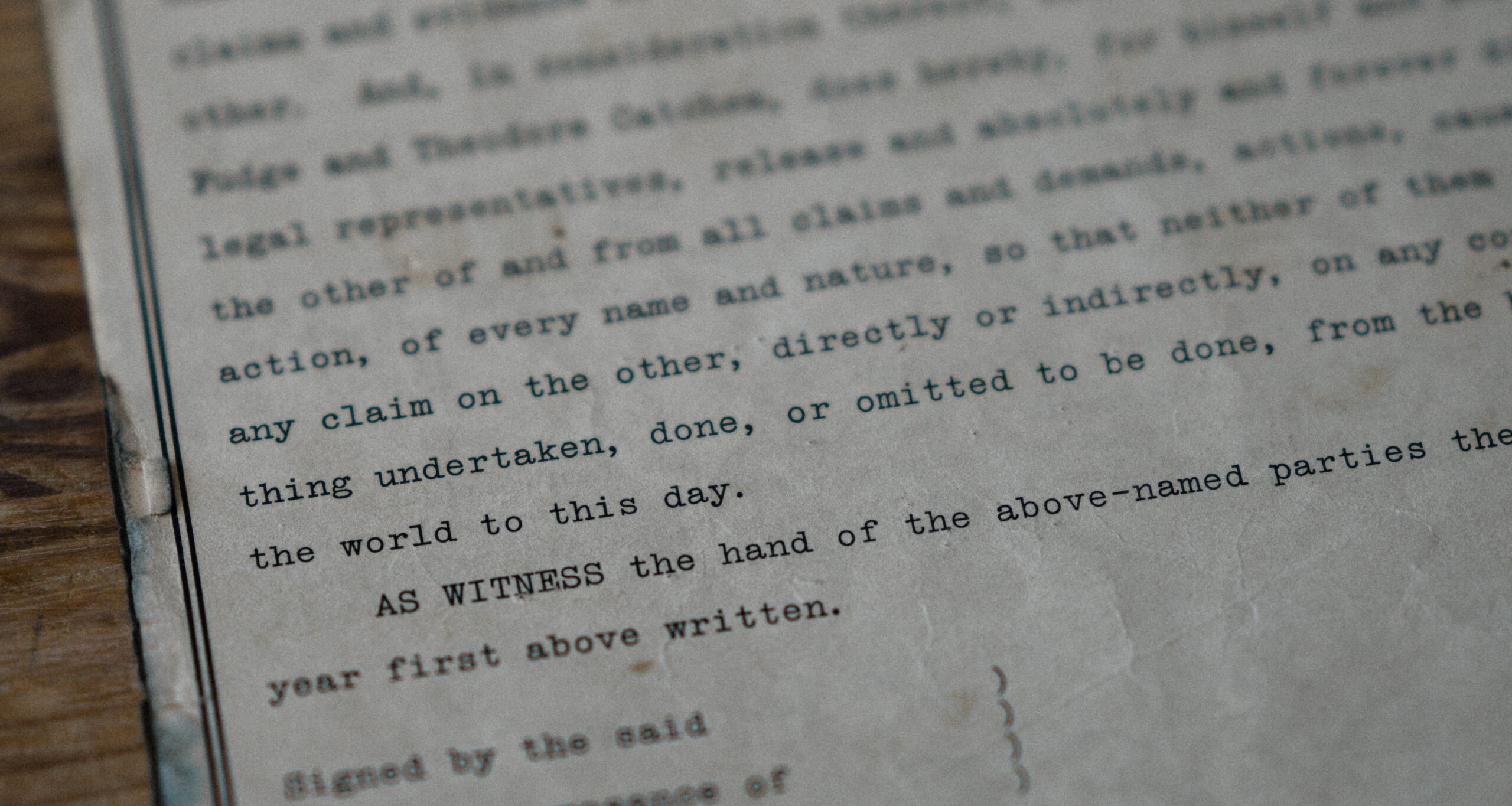

Common Maryland Deeds Described in Plain Language

A Deed is a legal document confirming ownership of a piece of real estate, such as land or a house. The three most common deeds in Maryland are a General Warranty Deed, a Special Warranty Deed, and a Quitclaim Deed. In a General Warranty Deed the grantor (or seller) declares that the property title […]

Read MoreWhat Does Maryland Intestate Mean and Why Does it Matter?

Intestate is when a person dies without a valid will. When this happens in Maryland, the state decides how to distribute any property or asset inheritance, including how much each family member will receive. According to Maryland Intestacy Laws, your surviving spouse will receive half of your estate, while your surviving children receive the […]

Posted by reichertlegal

Posted by reichertlegal- Posted in Uncategorized

Apr, 15, 2022

Apr, 15, 2022 No Comments.

No Comments.

Free Confidential Consultation. Call Now! 410-299-4959

Free Confidential Consultation. Call Now! 410-299-4959 Join Us On Facebook

Join Us On Facebook Join Us On Twitter

Join Us On Twitter Join Us On In.com

Join Us On In.com Subscribe to RSS

Subscribe to RSS Follow Us On Google+

Follow Us On Google+ Subscribe Us On Youtube

Subscribe Us On Youtube Follow Us On Pinterest

Follow Us On Pinterest Follow Us On Instagram

Follow Us On Instagram Follow Us On Tumblr

Follow Us On Tumblr Subscribe Us On Flickr

Subscribe Us On Flickr